As the landscape of healthcare and insurance continues to evolve, individuals are looking for clarity on the potential changes that the 2026 IRMAA (Income-Related Monthly Adjustment Amount) brackets may bring. IRMAA is a crucial aspect of Medicare Part B and Part D premiums, affecting how much individuals pay based on their income levels. In this article, we will delve into the possible 2026 IRMAA brackets and discuss expert solutions designed to help navigate these adjustments seamlessly.

What are IRMAA Brackets?

IRMAA brackets are income thresholds set by the government that determine the premium amount for Medicare Part B and Part D. These brackets are adjusted annually to reflect changes in the cost of living and healthcare expenses. The idea behind IRMAA is to ensure that higher-income beneficiaries contribute more towards their Medicare premiums, helping to sustain the program for all beneficiaries.

Possible 2026 IRMAA Brackets

While the exact figures for the 2026 IRMAA brackets have not been officially announced, we can look at previous trends and proposed adjustments to anticipate what the new brackets might look like. Generally, the government aims to adjust these brackets to keep pace with inflation and the growing costs of healthcare services. If the past is any indicator, we might see a slight increase in the income thresholds, potentially reducing the number of individuals who fall into higher premium tiers.

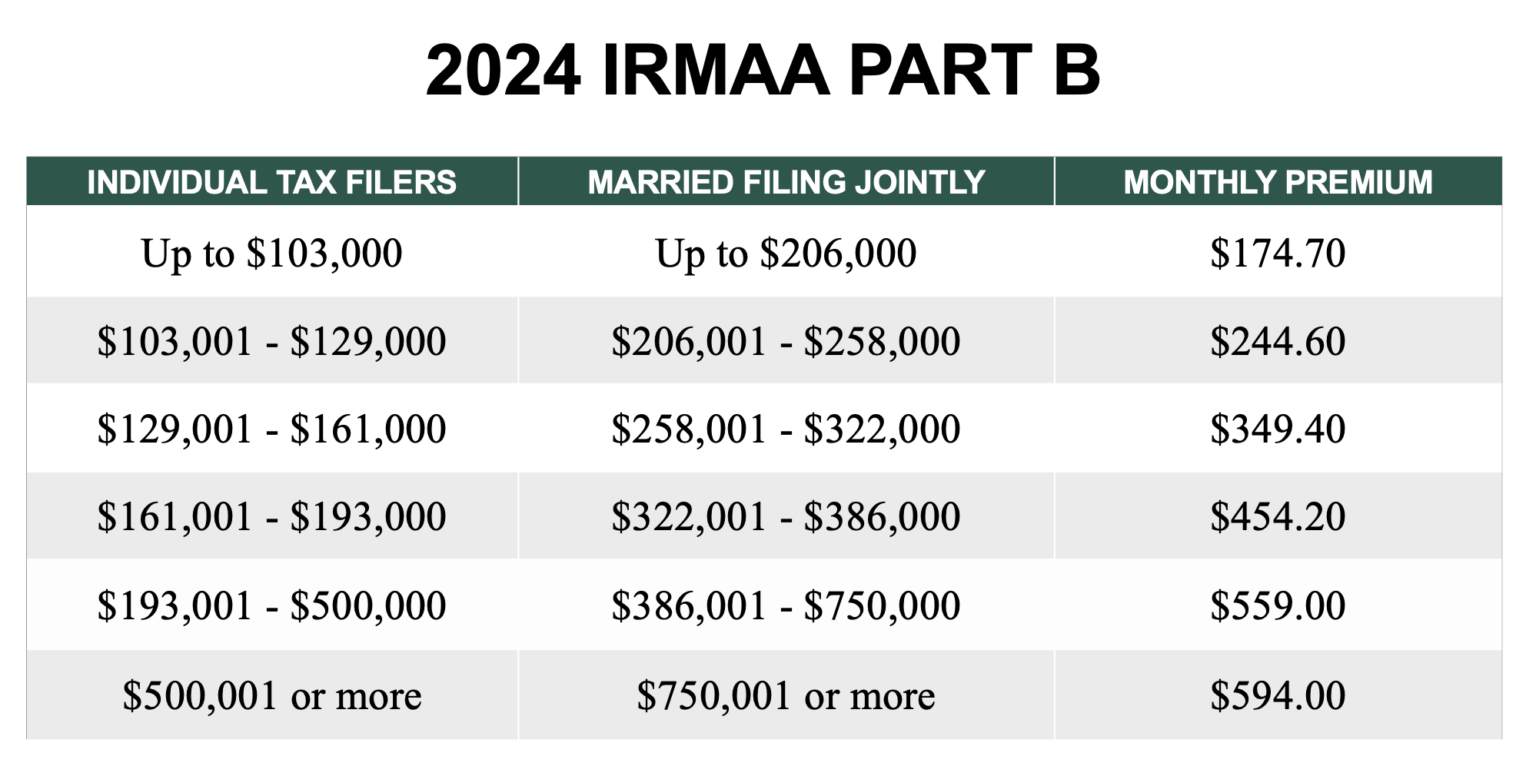

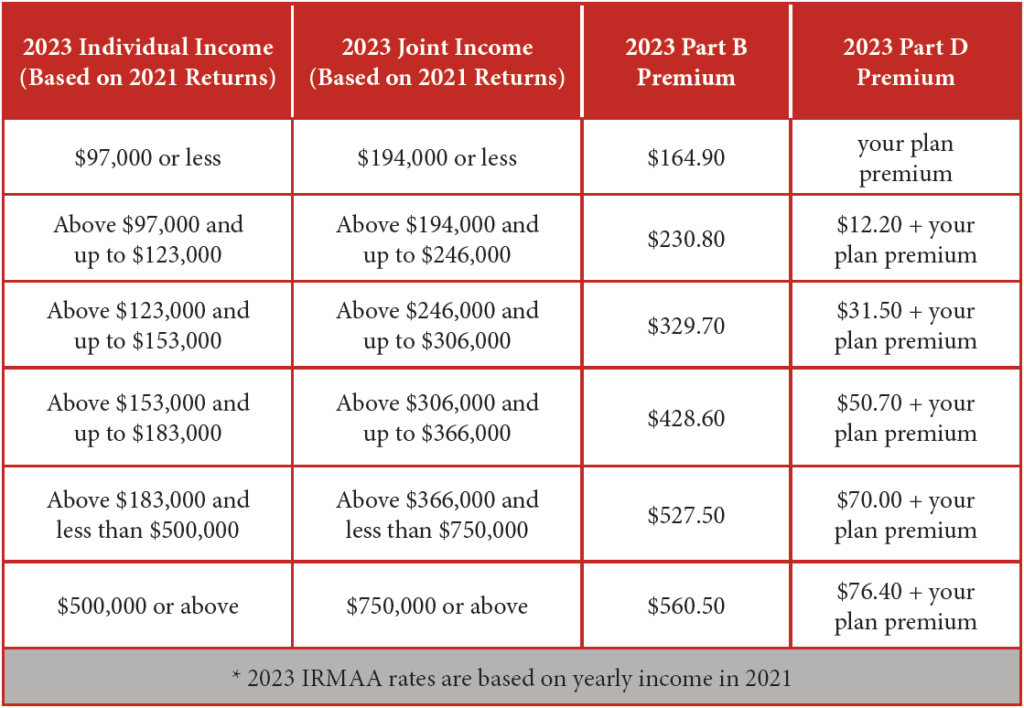

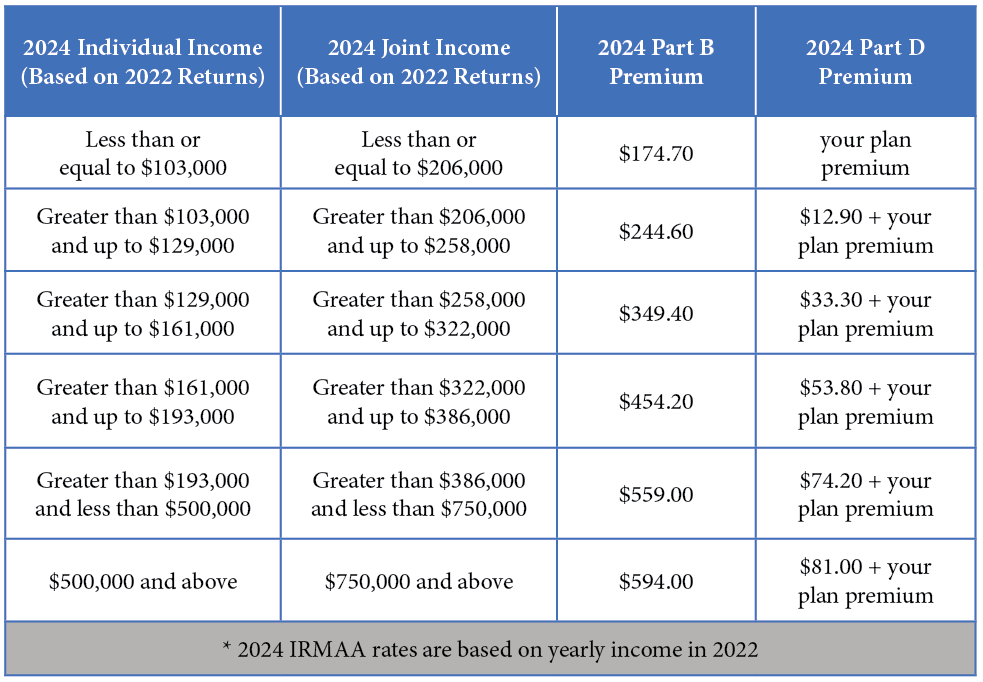

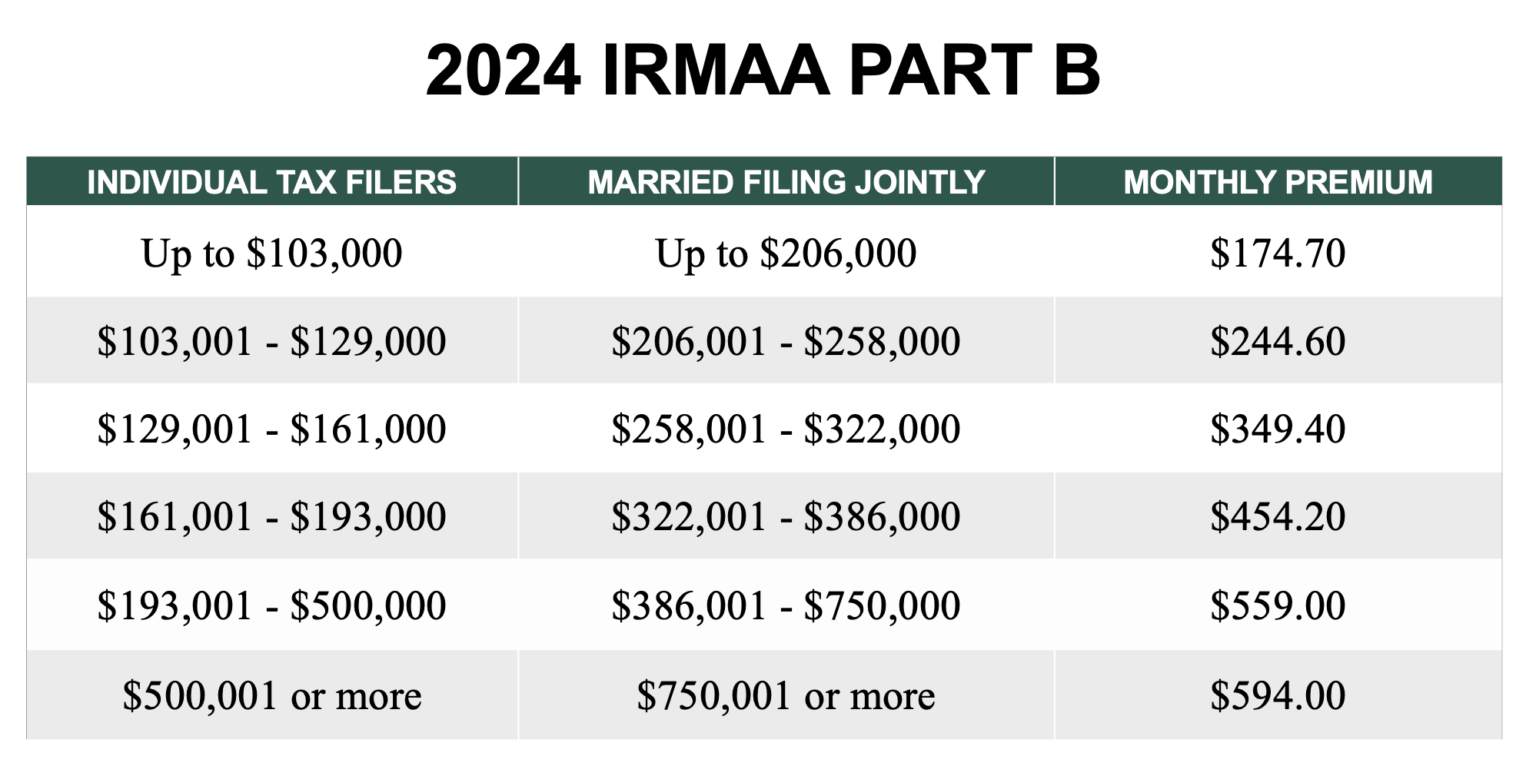

For instance, in recent years, the income thresholds have been as follows:

- Single individuals with incomes below $91,000 and joint filers with incomes below $182,000 are not subject to IRMAA adjustments.

- Higher income levels are divided into several tiers, each with its corresponding premium adjustment.

The 2026 brackets might continue this trend, with potential adjustments to these income levels and the associated premiums. It's essential for individuals, especially those nearing retirement or already enrolled in Medicare, to stay informed about these changes to plan their healthcare expenses effectively.

IRMAA Solutions for a Secure Future

Navigating the IRMAA brackets and understanding how they impact your Medicare premiums can be complex. Here are some expert solutions to consider for a secure future:

1.

Consult a Medicare Advisor: Working with a knowledgeable advisor can help you understand the IRMAA brackets and how they apply to your situation. They can provide personalized advice on minimizing your premium costs.

2.

Income Planning: For those nearing retirement, planning your income strategically can help avoid higher IRMAA tiers. This might involve timing retirement accounts withdrawals or considering how other income sources, like capital gains, could impact your IRMAA status.

3.

Medicare Advantage Plans: Some Medicare Advantage plans offer more comprehensive coverage at competitive prices, potentially mitigating the impact of IRMAA adjustments on your healthcare expenses.

4.

Stay Informed: Keeping up-to-date with the latest announcements from Medicare and understanding how policy changes might affect your premiums is crucial. Official government websites and reputable healthcare news sources can provide valuable insights.

The possible 2026 IRMAA brackets, while not yet confirmed, are likely to continue the trend of adjusting income thresholds to reflect economic changes. By understanding these brackets and exploring IRMAA solutions, individuals can better prepare for their healthcare expenses and ensure a more secure financial future. Whether through strategic income planning, consulting with a Medicare advisor, or exploring alternative Medicare plans, being proactive is key to navigating the complexities of IRMAA adjustments. Stay ahead of the curve and ensure that you're ready for whatever the 2026 IRMAA brackets may bring.